Hello! We're excited to bring you this midweek (Wednesday) edition of top trade ideas and market insights. Stay ahead with OptionEdge.ai! 🚀

Welcome to Your Midweek Insights 🎯

Wednesday's Trading Updates and Opportunities

By OptionEdge.ai

Exclusive Premium Content

This content is exclusive to premium members.

Market Recap

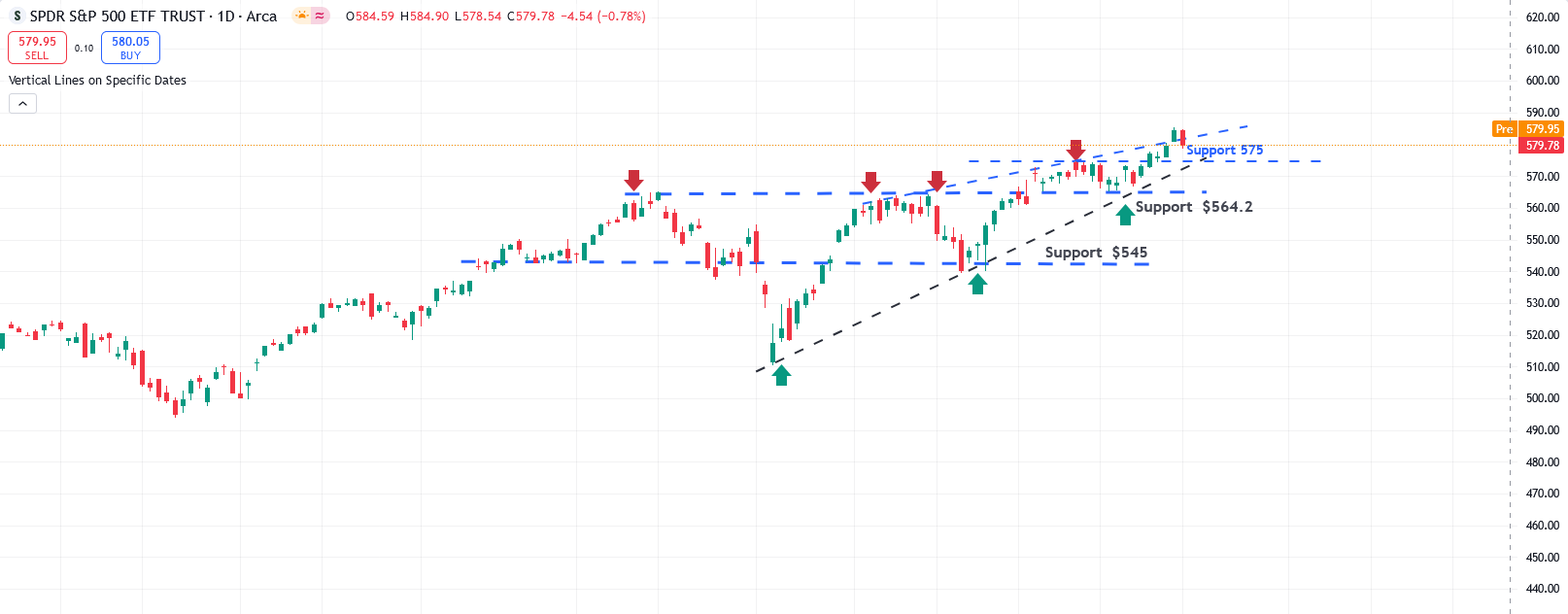

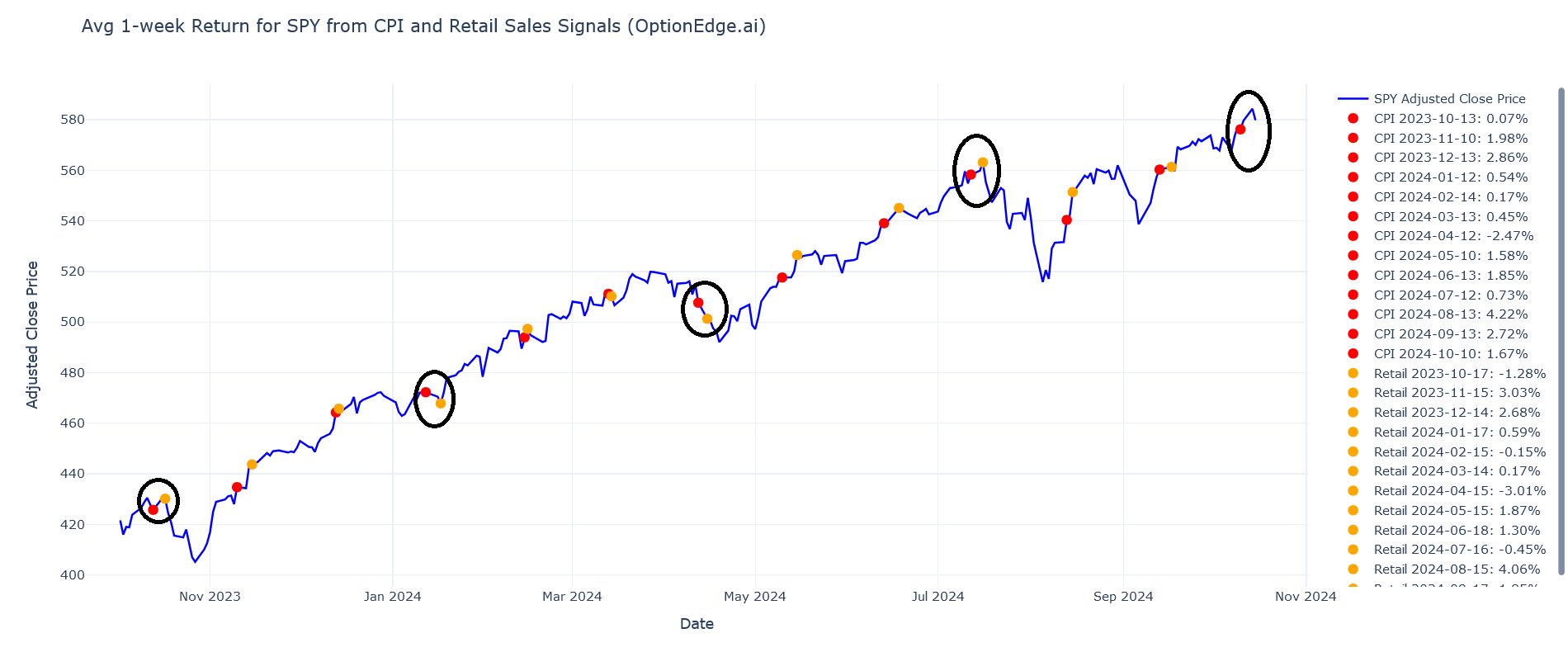

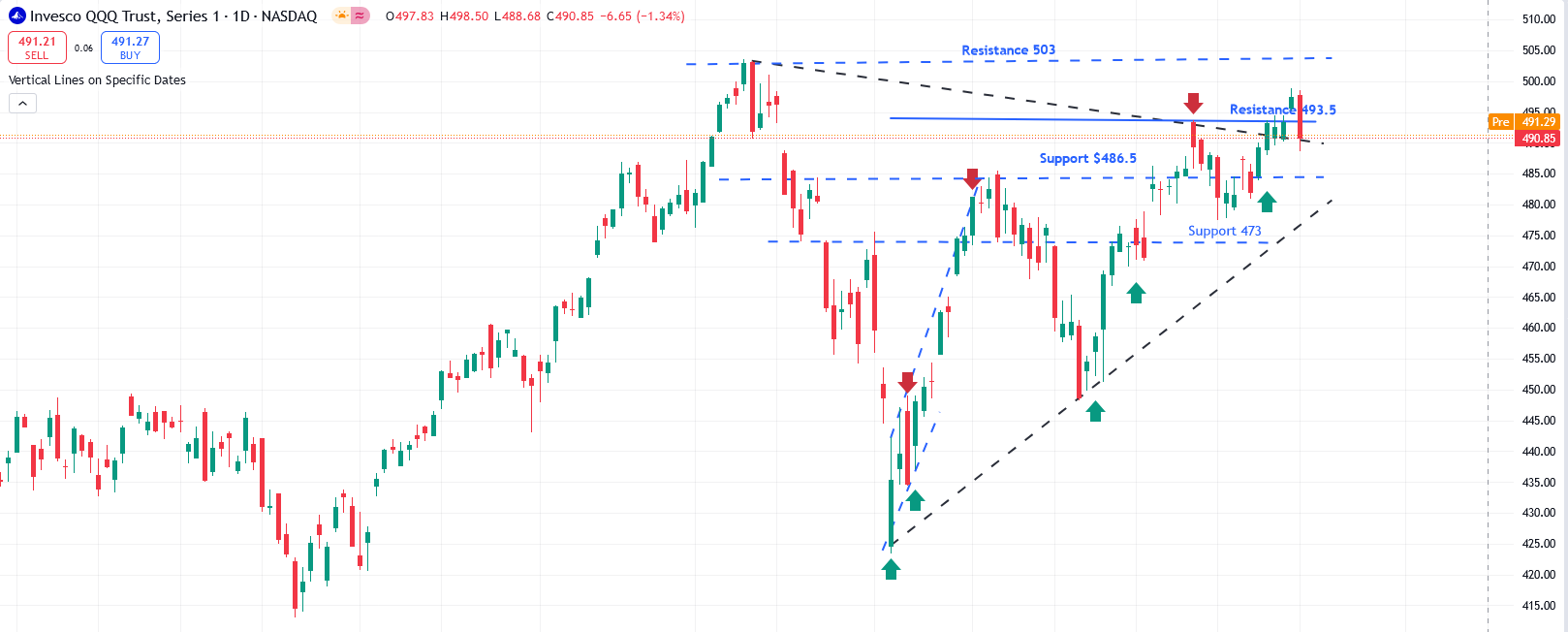

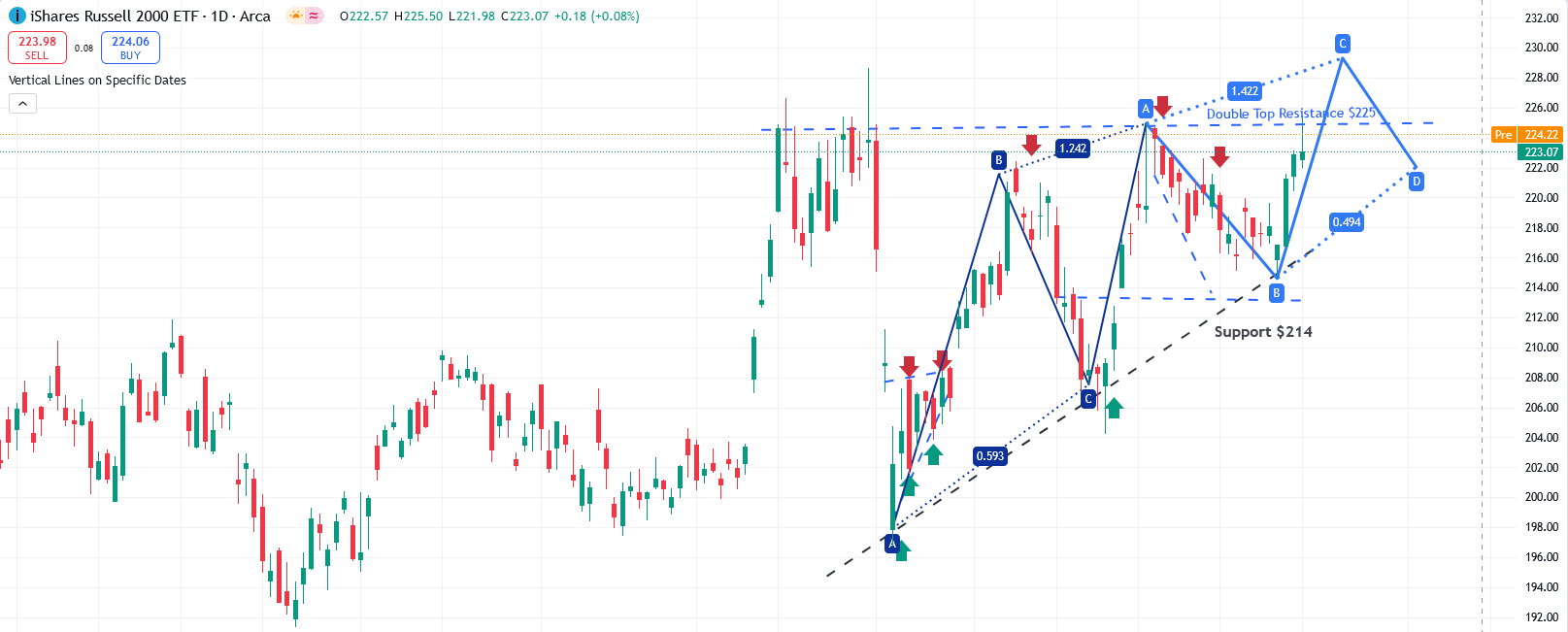

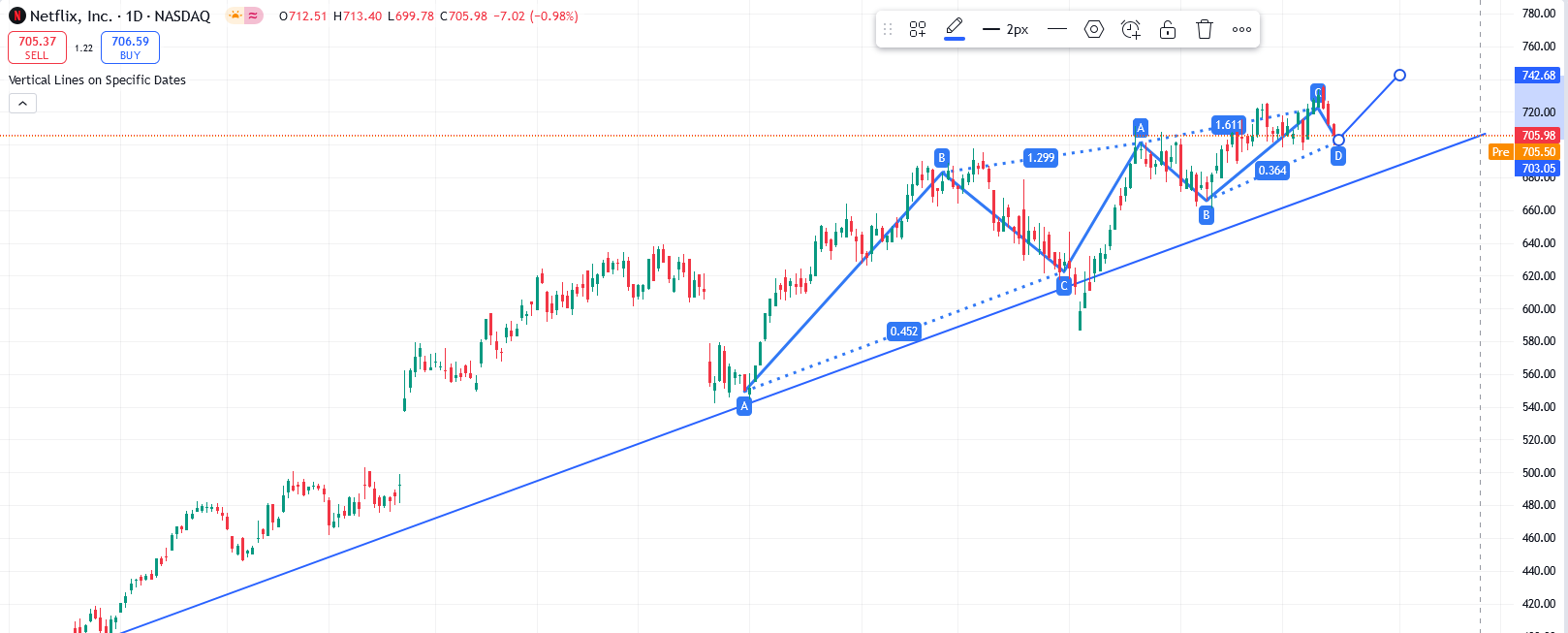

As we anticipated, the market started rising again on the Columbus Day holiday, reaching an all-time high, but then retreated about 1% from that peak. Volatility (VIX) remains elevated at 20. In our view, this level of volatility is typical for October, especially during election years and the earnings season. Historically, the third and fourth weeks of October tend to be risky. Since the market is at an all-time high (ATH), quick profit-taking is important, as a flash correction of up to 4% could occur between now and election day

💡 Trading Tip of the Week: "Using Support and Resistance Levels" for Better Trade Decisions 💡

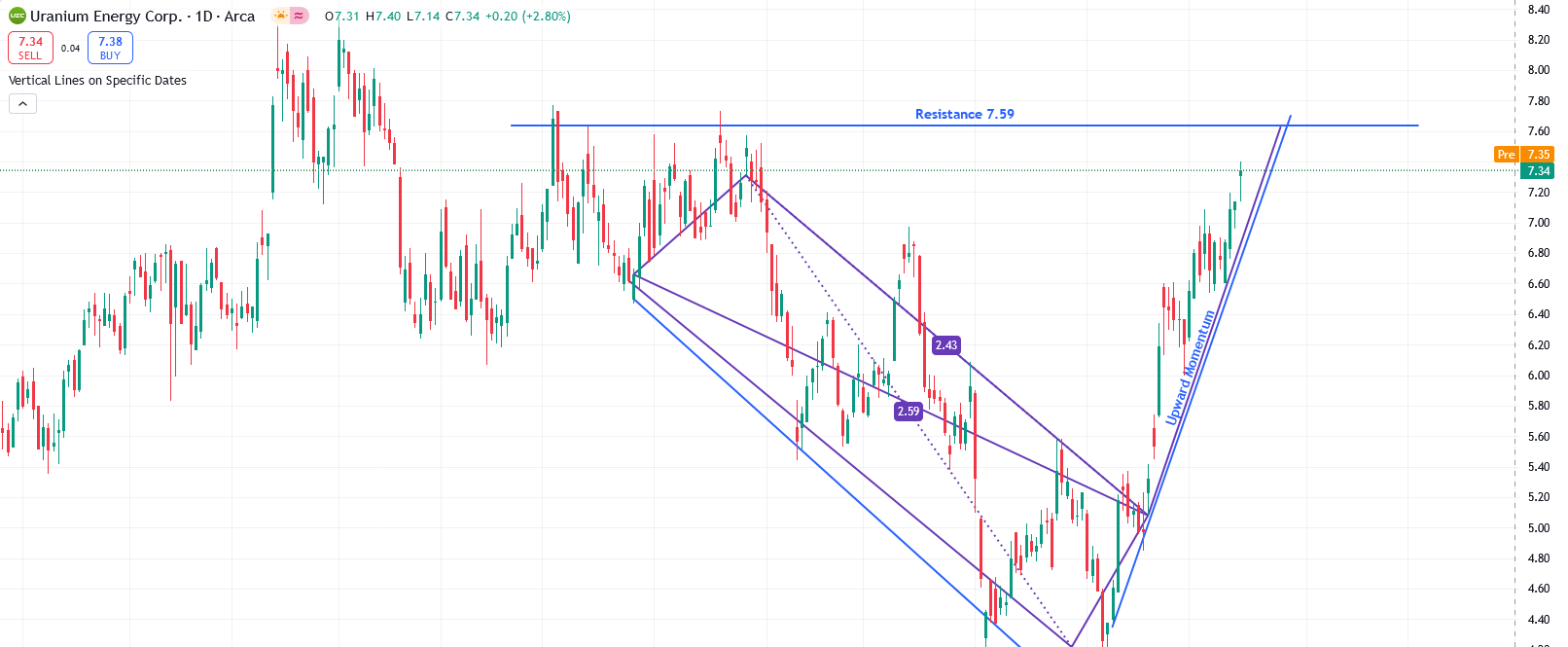

Strategy: Understanding and utilizing support and resistance levels is essential for making informed trading decisions. Support levels indicate where a stock has historically had difficulty falling below, while resistance levels show where it has struggled to rise above. Use these levels to inform your entry and exit points. Consider entering a trade near support levels with a tight stop loss just below, as this can provide a favorable risk-to-reward ratio. Conversely, consider taking profits or placing stop losses near resistance levels, as the price may struggle to break through. This strategy can help you navigate market fluctuations and improve overall trade management.