Hello! We’re excited to bring you this week’s top trade ideas and market insights. Stay ahead with OptionEdge.ai! 🚀

Welcome to Your Weekly Edge 🎯

Weekend Update on Trading Insights and Opportunities

By OptionEdge.ai

Exclusive Premium Content

This is content that only premium members can access.

Market Recap

For the week ending October 11, 2024, the market once again displayed remarkable resilience, closing at a new all-time high. Despite this upward momentum, the CBOE VIX Index, a key measure of market volatility, remained elevated, finishing above 20. Let’s break down the key drivers behind these market dynamics in more detail

- SPY (S&P 500 ETF): The market began the week with heightened volatility, largely driven by geopolitical tensions. However, it gradually recovered as the week progressed, closing up 1.15% from the prior week. JP Morgan's earnings report showed strength in lending growth, robust investment banking activities in M&A, and improvements in loss provisions. Despite facing cost pressures due to persistent inflation in Q3, the report was seen as a positive indicator for the economy, boosting overall market sentiment. Additionally, Thursday's CPI report raised hopes for a potential 25-basis-point rate cut by the Federal Reserve in November, further fueling market optimism. The Fed’s dovish stance continues to support liquidity, driving the market higher.

- Looking ahead, SPY appears to be breaking out of its trading range between 565 and 575, with expectations of resuming its uptrend. The ETF could push towards the 583–584 range early next week and settle near 579 by the week's end. Although SPY is reaching new all-time highs, the VIX remains stubbornly elevated, suggesting underlying risks. The VIX’s persistent rise above 20 indicates potential market instability, but ample liquidity continues to provide a strong tailwind. On the macroeconomic front, concerns remain: inflation is not cooling, auto sales are declining while inventories are rising, and premiums for auto and health insurance continue to climb alongside food prices. Additionally, credit card delinquency rates are spiking, and rising mortgage rates are expected to dampen housing sales and lending growth.

- QQQ (Nasdaq 100 ETF):Similar to SPY, QQQ began the week on a downtrend but managed to recover, closing 1.25% higher than the prior week. However, it has yet to reclaim its all-time high (ATH) reached in July. The upcoming earnings report from Netflix (NFLX) may spark positive sentiment in the tech sector, particularly with streaming growth expectations. Additionally, Taiwan Semiconductor Manufacturing Company (TSMC) is set to report earnings on Thursday, which could provide crucial insights into AI GPU demand, potentially boosting the overall sentiment for semiconductor stocks.

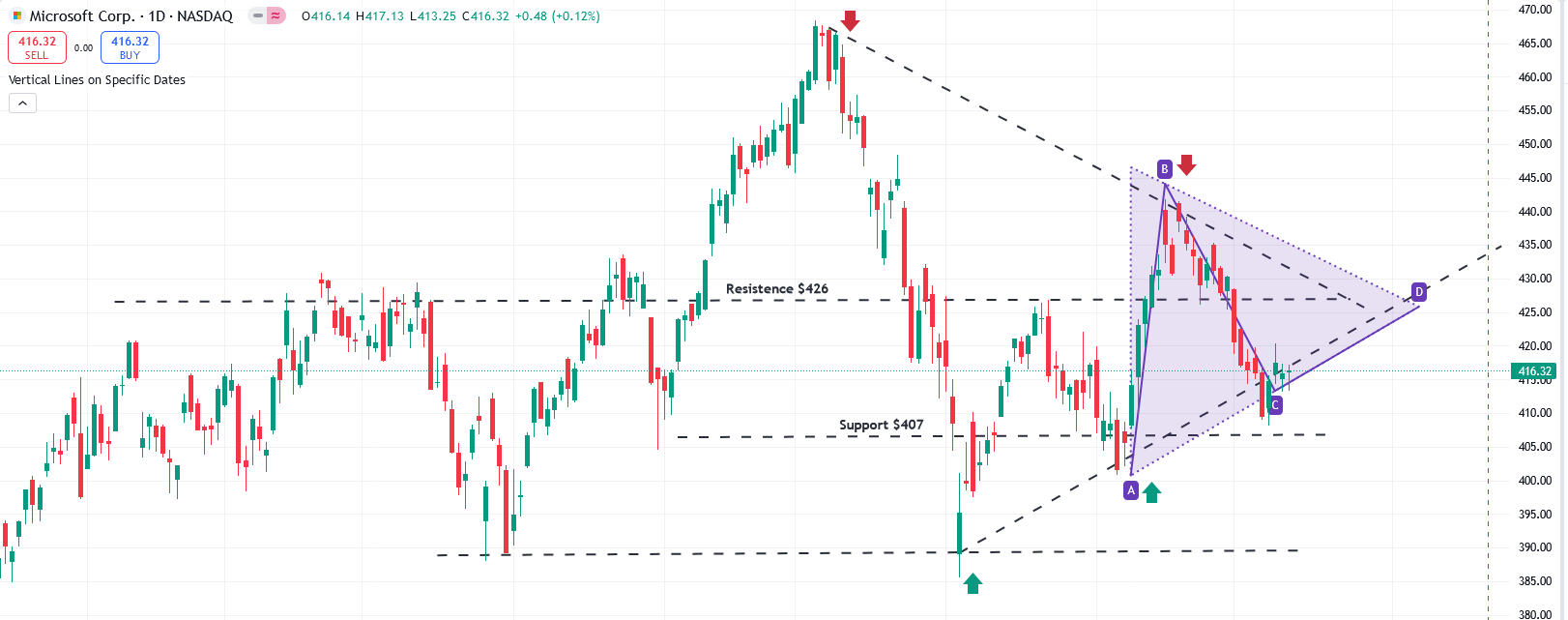

- Looking ahead, QQQ closed near its resistance level of 493 and is expected to resume its uptrend early next week, potentially reaching the 497 level and settling near 494 by week's end. If NFLX and TSMC deliver strong earnings results, QQQ could see a swift rise towards 503. However, the elevated VIX, which remains above 20, poses a potential risk, as heightened volatility could dampen tech sector gains. Moreover, key components like Tesla (TSLA) and Microsoft (MSFT) are currently facing challenges, and their performance will likely continue to influence QQQ's overall sentiment.

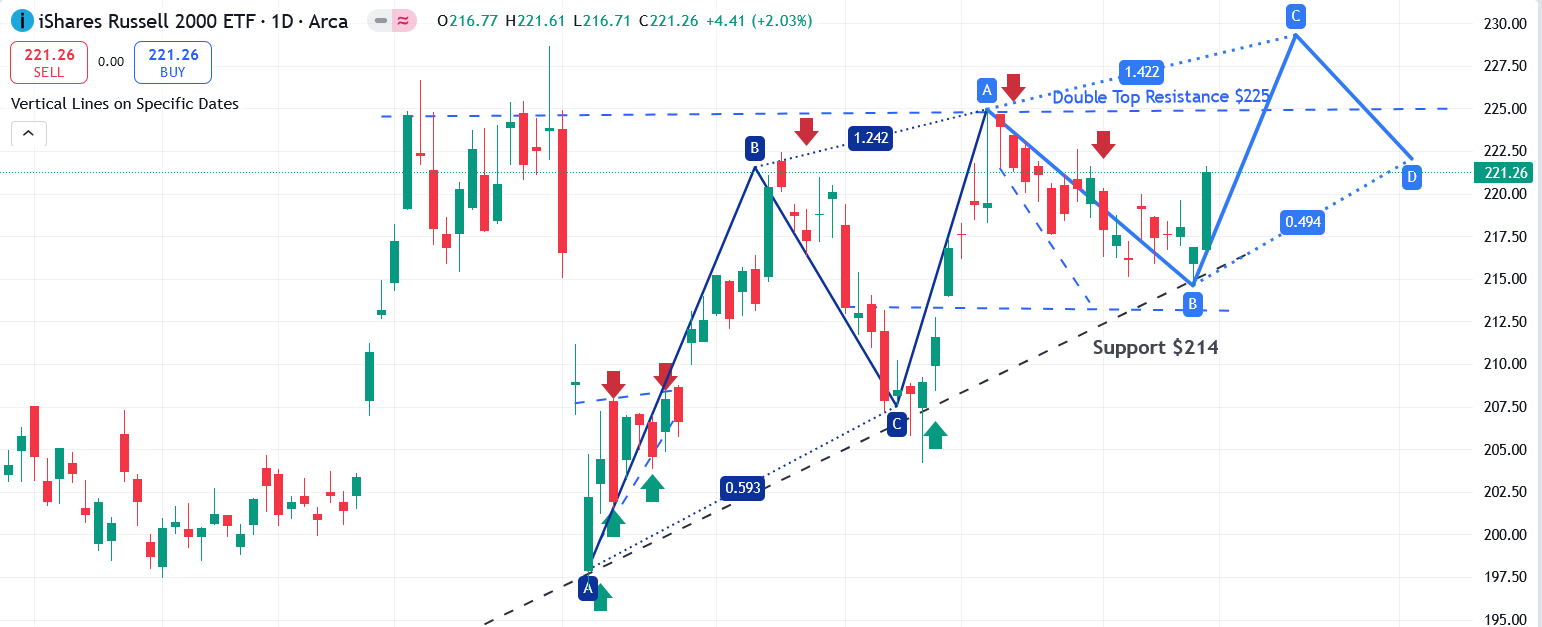

- IWM (Russell 2000 ETF): In contrast to large-cap indices, IWM struggled for most of the week. However, Friday's session saw a turnaround, driven by positive earnings from JPMorgan, which helped boost sentiment among small-cap stocks. IWM closed the week up 1% from the prior week. Notably, about 10% of IWM’s constituents come from regional banks, and their performance is closely tied to lower interest rates and positive outlooks from major financial players like JPMorgan (JPM) and Goldman Sachs (GS).

- Looking ahead, IWM has broken out from a key weekly trendline, signaling potential for further gains. Next week, earnings reports from regional banks and other financial institutions could provide additional momentum for IWM, given its significant exposure to the banking sector.

In summary, while SPY demonstrated resilience, the QQQ was supported by mixed performances from the 'Magnificent 7' group of stocks, which helped the index close the week on a positive note. On the other hand, IWM faced challenges due to ongoing economic pressures. As highlighted in our mid-week insight, Palantir (PLTR) delivered impressive performance. However, our bearish outlook on SPY and IWM, along with our bullish stance on Tesla (TSLA), did not materialize as anticipated.

Interest Rates:

The U.S. 10-year Treasury yield continued its upward trajectory, reaching approximately 4.1%, a level not seen since July. This rise reflects the market's adjustment to the broader economic outlook. While a potential rate cut by the Federal Reserve could influence shorter-term rates, such as the 2-year Treasury, longer-term yields like the 10-year are more closely tied to market expectations for economic growth and inflation.

Mortgage Rates:

Following the upward trend in Treasury yields, mortgage rates have also edged higher. The 30-year fixed mortgage rate is now hovering around 6.64%, a level that could dampen housing market activity and borrowing demand. These higher rates are likely to put additional pressure on homebuyers and could slow down the broader real estate market in the coming months.

Oil Prices:

Oil prices settled above $75 per barrel, driven largely by ongoing geopolitical conflicts in the Middle East. This price increase has significant implications for inflation, as rising energy costs can ripple through various sectors, potentially putting additional pressure on both consumers and the broader market.

Next Week's Action Plan:

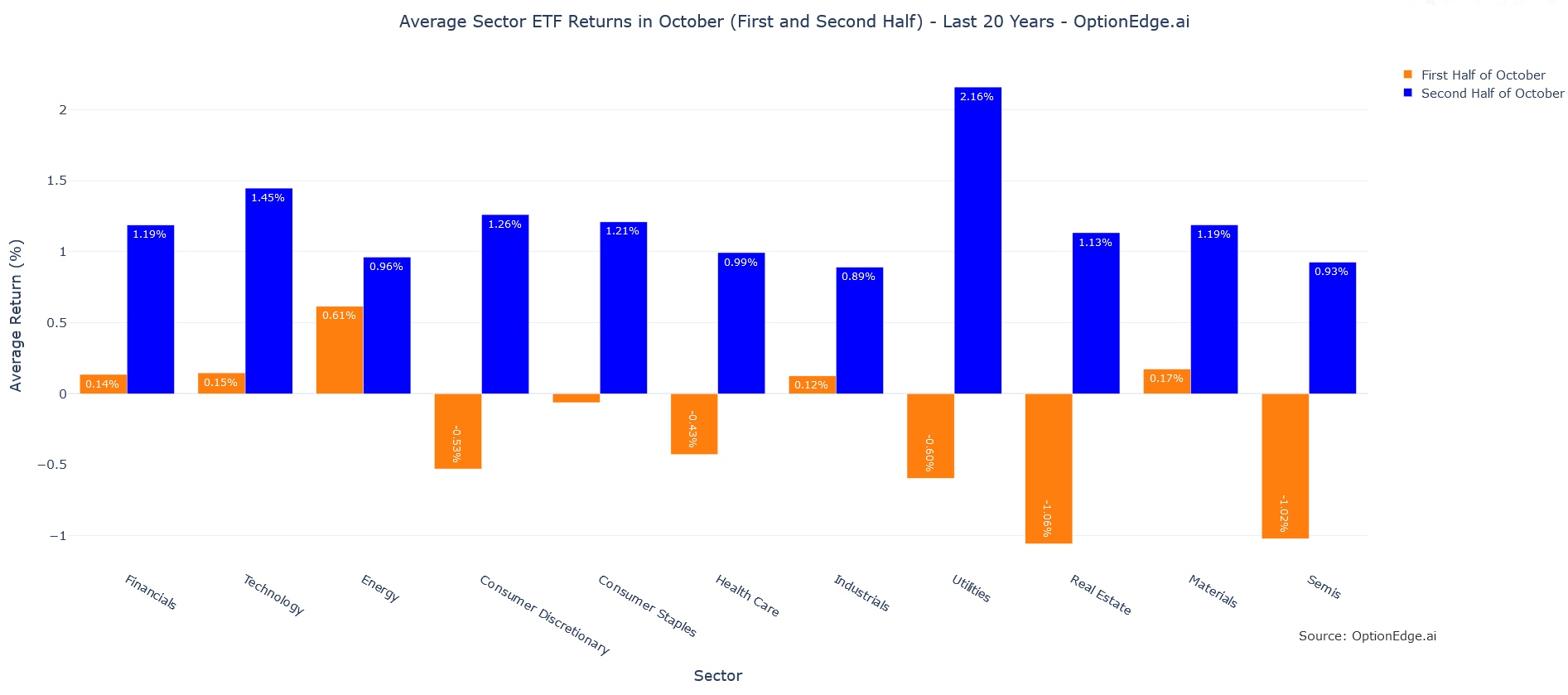

Looking ahead, Monday, October 14th is Columbus Day, meaning the bond market will be closed while the stock market remains open. Historically, equity markets tend to rise during bond market holidays. Next week is relatively light on major economic events, with the primary focus being Thursday’s retail sales report and a few speeches from Federal Reserve governors. In the absence of significant economic data, the market is likely to maintain its uptrend, although Friday could see some pullback if the VIX remains elevated above 20. Key earnings reports to watch include financial giants Goldman Sachs (GS) and Morgan Stanley (MS), along with notable releases from Netflix (NFLX) and TSMC on Thursday, which could influence market direction.

This research is intended for OptionEdge AI clients only.

OptionEdge AI subscriptions are limited to a single user, and this research must not be shared, redistributed, or disclosed to others. For more information, please contact support@optionedgeai.com.

Conflicts of Interest

This research reflects the views, opinions, and recommendations of OptionEdge AI. At the time of publication, OptionEdge AI has no knowledge of any material conflicts of interest related to this content.

General Disclosures

OptionEdge AI is an independent research firm and is not registered as an investment advisor or broker-dealer under any federal or state securities laws.

This communication is issued by OptionEdge AI for informational and educational purposes only. It is not a personal recommendation, offer, or solicitation to buy or sell any securities, financial products, or services. This material should not be considered legal, tax, accounting, or investment advice. It is not prepared in compliance with legal requirements to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

This document is intended solely for the recipient and may not be distributed without the prior consent of OptionEdge AI.

Copyright © 2024 OptionEdge AI. All rights reserved. No part of this material may be reprinted, sold or redistributed without the prior written consent of OptionEdge AI