This content is exclusive to premium members.

Hello! We're excited to bring you this midweek (Wednesday) edition of top trade ideas and market

insights. Stay ahead with OptionEdge.ai! 🚀

Market Recap

The week began with heightened volatility as expected, driven by concerns over the parabolic rise in

China's market.

The U.S. markets were initially anxious about potential capital rotation to China. However, this fear

was short-lived.

On Tuesday, the Hang Seng Index plummeted by 10%, sparking optimism on Wall Street, with hopes that

money would stay within U.S. markets.

In our view, this volatility is typical of October, especially during election years. Historically, the

second and third weeks of October

tend to be challenging, and we maintain a bearish outlook for the near term.

- SPY (S&P 500 ETF):started the week with a pullback but rebounded from its lows by

Tuesday, reflecting a choppy and

indecisive market. The rapid swings in just two days signal market uncertainty or "indigestion."

Notably, SPY failed to break through its all-time high of 475, which it reached on September 26th.

The

10-year Treasury yield climbed above 4%, closing at 4.03%, adding pressure on equities.

Additionally,

the VIX closed at 21.5, and staying above 20 suggests continued volatility, creating a headwind for

broader market gains.Looking ahead, SPY’s movement will likely hinge on economic data, particularly

FOMC minutes and inflation updates. With the VIX elevated and interest rates rising, investors

should

brace for more volatility in the coming weeks

- QQQ (Nasdaq 100 ETF): underperformed the broader market this week, as expected. It

struggled to break through its all-time high set in July, reflecting weakness in the tech sector.

Despite several attempts, the index has not been able to sustain momentum above this key resistance

level. Next week’s earnings reports from major tech companies will be critical in determining the

health of Big Tech and could provide the catalyst for QQQ’s next move

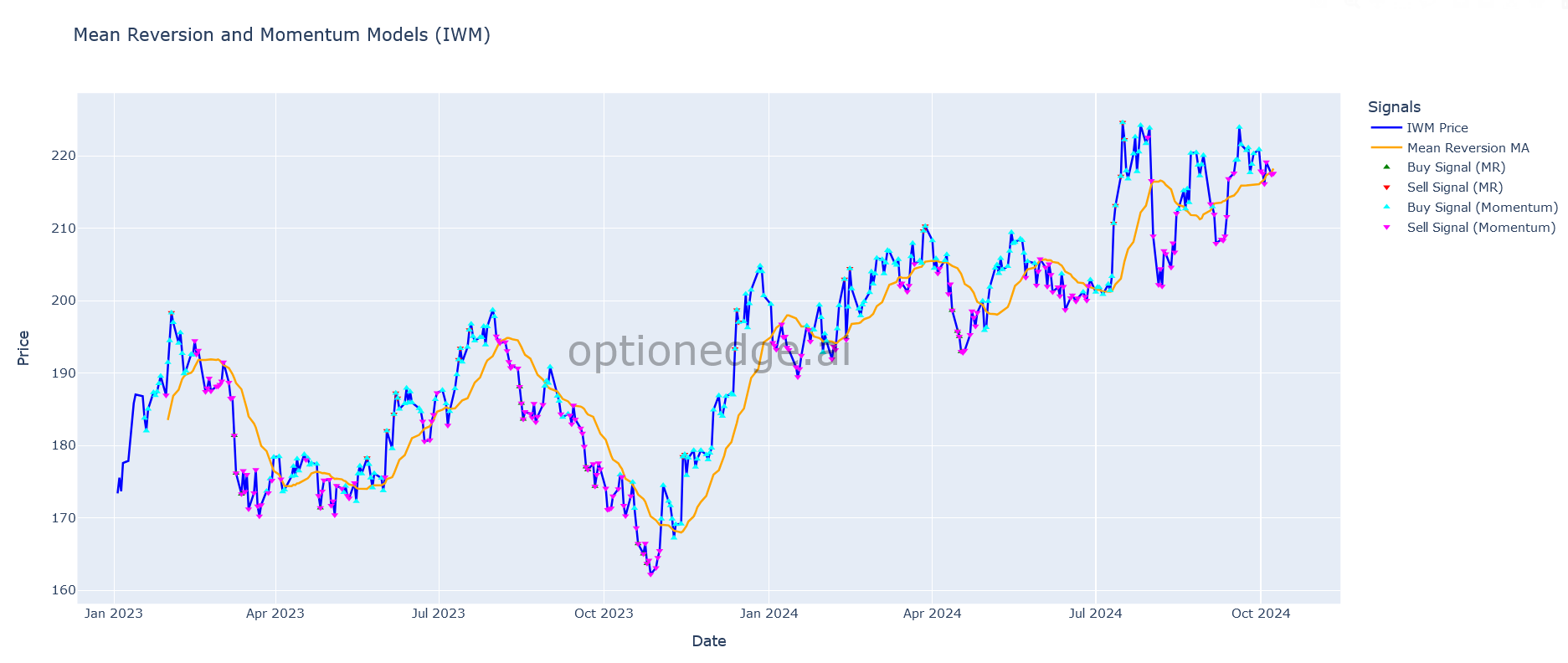

- IWM (Russell 2000 ETF): IWM remains in a downtrend, as evidenced by its weekly

candles. The index has struggled to break through immediate resistance around 220, reflecting

ongoing weakness in small-cap stocks. The upcoming CPI report will be a crucial factor in

determining whether IWM can stage a recovery or continue its bearish trend. For now, the ETF remains

under pressure, with no clear sign of a reversal.

Small-cap stocks are often more sensitive to shifts in economic data, so the CPI report could

significantly impact IWM's short-term direction. If inflation surprises to the downside, it may

provide the catalyst for a relief rally, but without that, the bearish momentum is likely to

persist.

Action Plan for the Week

Looking ahead, the focus will shift to key economic reports, with the FOMC minutes on Wednesday and

the CPI report on Thursday.

Both events are likely to be market movers. We remain cautious, especially in sectors like

semiconductors, energy, financials,

and commodities such as gold (GLD), which have shown signs of weakness.

GLD corrected as anticipated, and we successfully closed our put positions. As mentioned in last

week's newsletter,

the long-term trend for GLD remains intact, and we expect a resumption of the rally, potentially

targeting 250 within the next two months.

For October, we're focusing on sectors that tend to perform well historically, such as retail (COST,

WMT) and consumer discretionary names like Chipotle (CMG).

Featured Trade Ideas

- Gold (GLD): Historically, GLD tends to underperform in early October, but it

has strong support near 240.

We expect it to resume its uptrend, with the potential to rally further in line with Elliott

Wave analysis (Wave 5). A breakout above 240

could signal further upside toward 250 in the coming months.

- TSLA: TSLA's upcoming Robotaxi event is expected to introduce volatility. We

remain bullish on TSLA

but are waiting for a solid entry point. There’s strong support around 233, and a dip to this

level could present a good long opportunity.

Additionally, TSLA may benefit from potential policy tailwinds, making it a strategic "Trump

trade."

- AMD: As highlighted in last week's newsletter, semiconductors often

underperform in early October. While AMD is

breaking out of its trendline, our Quant model indicates bearish divergence, suggesting this

could be a false breakout. There is strong resistance around 182.

If AMD hits this level, it may offer a good setup for a PUT option.

- PSTG: PSTG is encountering resistance at the 200-day moving average. However,

it is breaking out from its base, and

the stochastic indicator is turning bullish. We expect PSTG to reach 56 by the end of October,

but it may encounter resistance at this level.

- ISRG: ISRG is entering a seasonally favorable period over the next three

months. The stock is in a strong uptrend and

is consolidating near the top of its channel. Immediate support is near 472, and we expect a

breakout through 490 soon, continuing its bullish momentum.

🔥 Featured Trade Idea: IWM 🔥

Rationale: Our AI Quant model suggests that IWM will experience ongoing volatility,

with the potential to test the 213–215

support levels in the next two weeks. If Thursday’s CPI report comes in soft, the index may resume

its uptrend. Key resistance levels to watch are 220, 223, and 225.

💡 Trading Tip of the Week: "Scaling In and Out" for Improved Trade Management 💡

Strategy: Scaling in and out of trades is a powerful technique to optimize both

entry and exit points. Instead of committing your entire capital at once, scale into positions

gradually as market conditions confirm your bias. This reduces risk and allows you to adjust your

position if the market moves against you. Similarly, scale out of trades to lock in profits

progressively, especially in volatile markets, while still keeping a portion of your position open

to benefit from potential further gains. This approach helps smooth out the volatility and gives

more control over risk management.