Hello! We’re excited to bring you this week’s top trade ideas and market insights. Stay ahead with OptionEdge.ai! 🚀

Welcome to Your Weekly Edge 🎯

Weekend Update on Trading Insights and Opportunities

By OptionEdge.ai

Exclusive Premium Content

This is content that only premium members can access.

Market Recap

For the week ending October 4, 2024, the markets appeared ready to move forward, giving the impression of calm. However, beneath the surface, we see significant imbalances. Let's dissect these developments in detail.

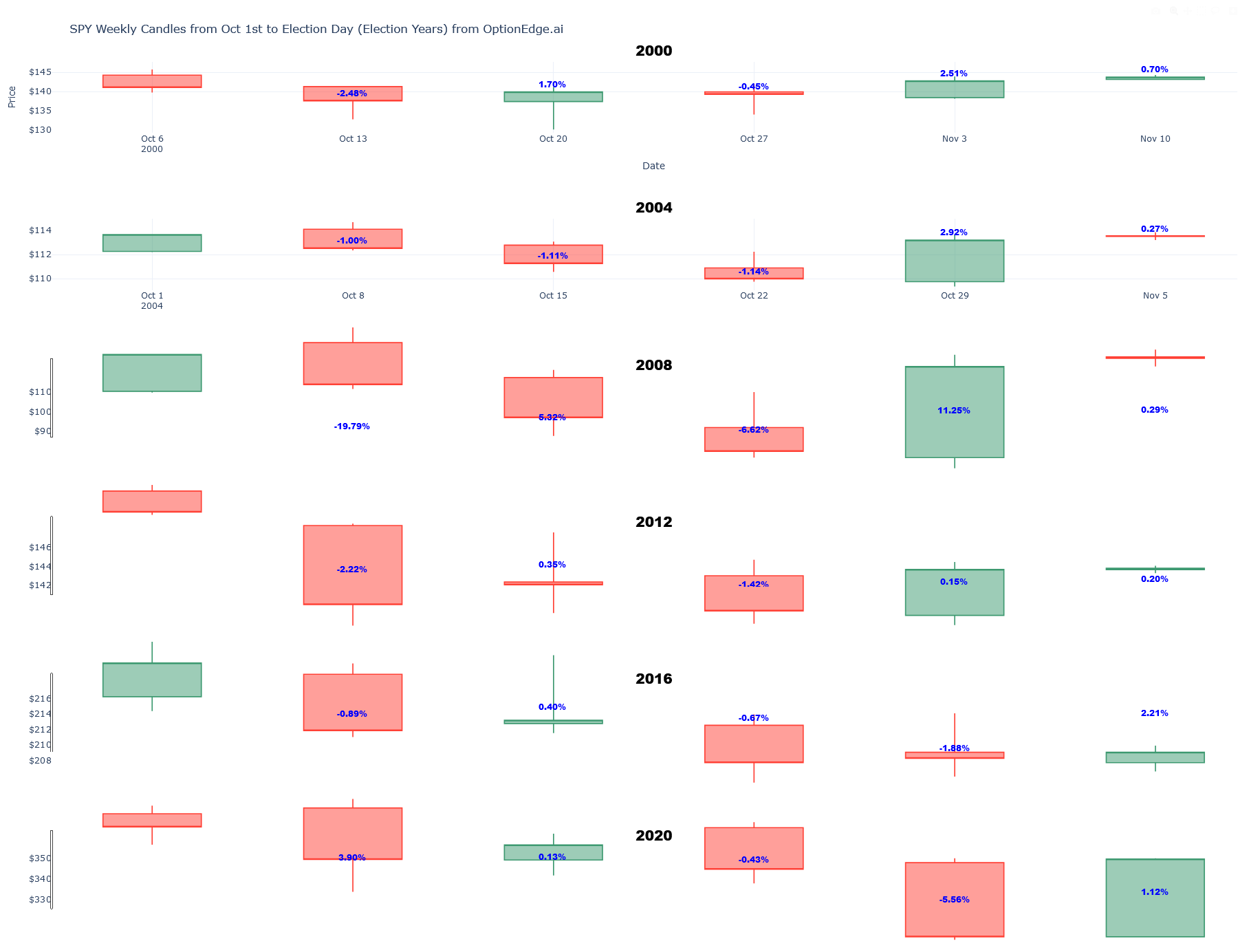

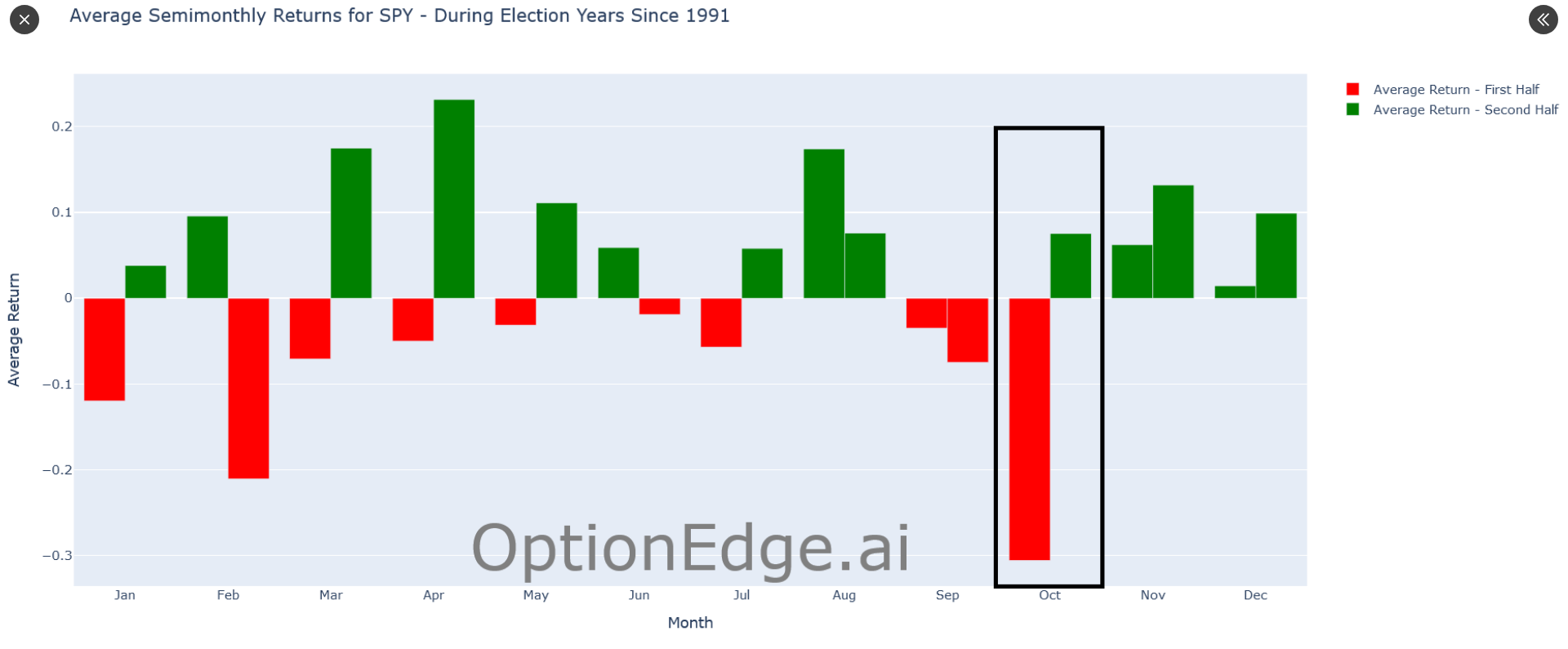

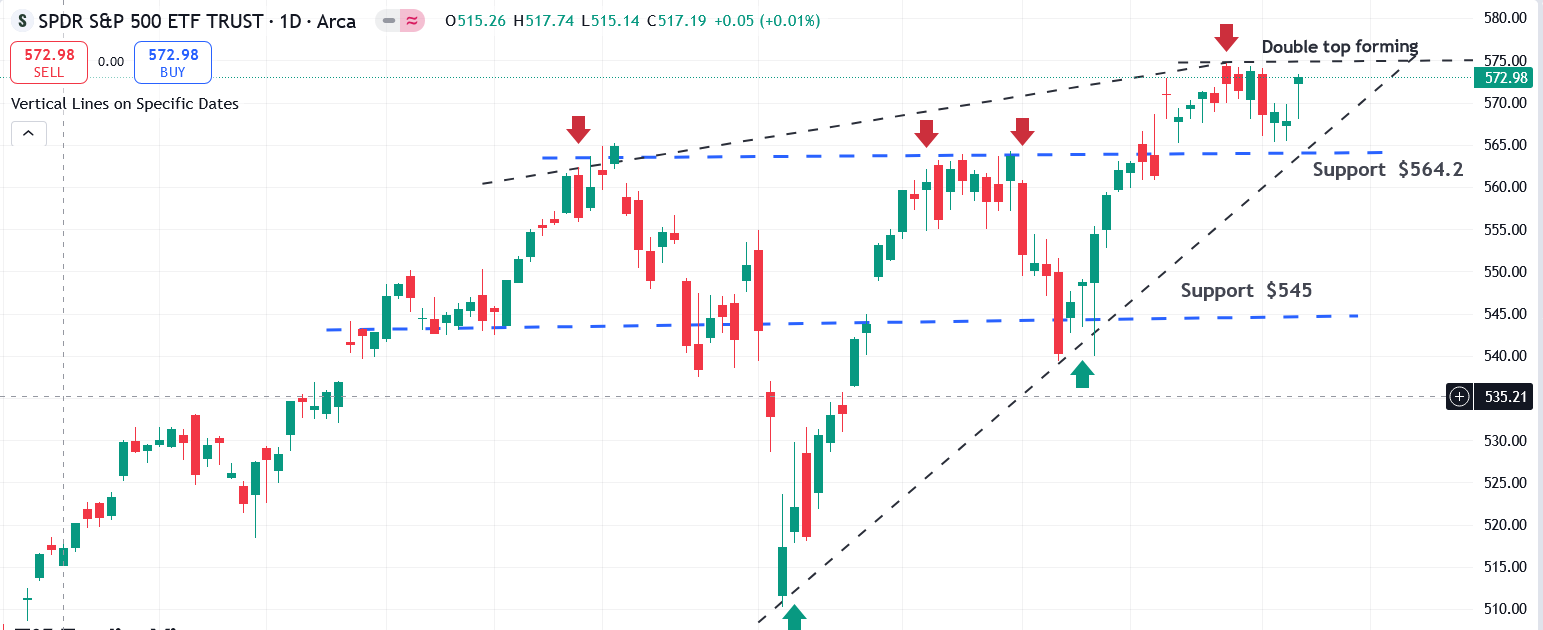

- SPY (S&P 500 ETF): The SPY experienced volatility at the beginning of the week but closed slightly positive by Friday, buoyed by strong job numbers. The market’s initial reaction to such economic data can often be misleading, with the real movement emerging in the following days. We expect volatility to increase due to rising yields and geopolitical tensions. While we remain bullish on the long-term market outlook, we are tactically cautious. Our expectation is for the VIX to spike, leading SPY to drop by 3% to 4%, targeting the 546 to 550 range in the next two weeks. This bold call is supported by our Quant model, which also indicates that institutions are rapidly increasing their cash reserves ahead of the elections. Next week’s focus will be on the FOMC minutes and CPI data for further clarity.

- QQQ (Nasdaq 100 ETF): Like SPY, QQQ started the week on a downtrend but managed to close positive, thanks to key constituents like Meta and Google, which helped lift the index into the green.

- IWM (Russell 2000 ETF): IWM had a weaker performance, ending the week lower. The strong job numbers have resurfaced concerns about how higher interest rates will affect smaller companies, and historically, the next two weeks are particularly challenging for small caps during election years.

In summary, while SPY showed resilience, QQQ faced challenges due to its tech-heavy composition, and IWM lagged under economic pressures. As mentioned in our mid-week insight on October 2nd, Meta and IYR performed excellently. However, our bearish outlook on AMD and SPY didn't play out as expected. We're currently reinforcing our Quant model with actual results to improve its accuracy moving forward.

Next Week's Action Plan

Looking ahead, the focus for next week will be on key economic data, including FOMC minutes on Wednesday, CPI on Thursday, and PPI on Friday. Volatility is likely to remain high as investors react to signals about the Federal Reserve's future policy decisions. Following the strong jobs report last Friday, the 30-year mortgage rate jumped 0.27% to 6.53%, and the 10-year Treasury yield spiked to 3.97%. Rising yields could dampen market performance. If inflation data continues to soften, combined with strong job growth, it could signal a "Goldilocks" scenario, where the economy is in balance. However, if inflation ticks up, it will likely be seen as a Fed policy mistake in cutting rates by 50bps in September and perceived as a headwind to corporate earnings. Also Market will react to it, if Fed easing cycle off the table due to strong econmic data and hot inflation.

This research is intended for OptionEdge AI clients only.

OptionEdge AI subscriptions are limited to a single user, and this research must not be shared, redistributed, or disclosed to others. For more information, please contact support@optionedgeai.com.

Conflicts of Interest

This research reflects the views, opinions, and recommendations of OptionEdge AI. At the time of publication, OptionEdge AI has no knowledge of any material conflicts of interest related to this content.

General Disclosures

OptionEdge AI is an independent research firm and is not registered as an investment advisor or broker-dealer under any federal or state securities laws.

This communication is issued by OptionEdge AI for informational and educational purposes only. It is not a personal recommendation, offer, or solicitation to buy or sell any securities, financial products, or services. This material should not be considered legal, tax, accounting, or investment advice. It is not prepared in compliance with legal requirements to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

This document is intended solely for the recipient and may not be distributed without the prior consent of OptionEdge AI.

Copyright © 2024 OptionEdge AI. All rights reserved. No part of this material may be reprinted, sold or redistributed without the prior written consent of OptionEdge AI