This content is exclusive to premium members.

Hello! We're excited to bring you this midweek (Wednesday) edition of top trade ideas and market

insights. Stay ahead with OptionEdge.ai! 🚀

Market Recap

As anticipated, October kicked off with heightened volatility. We expect the market to experience further

fluctuations until mid-October. Historically, the first half of October in election years tends to be

rough. We're focusing on solid setups for new trade opportunities.

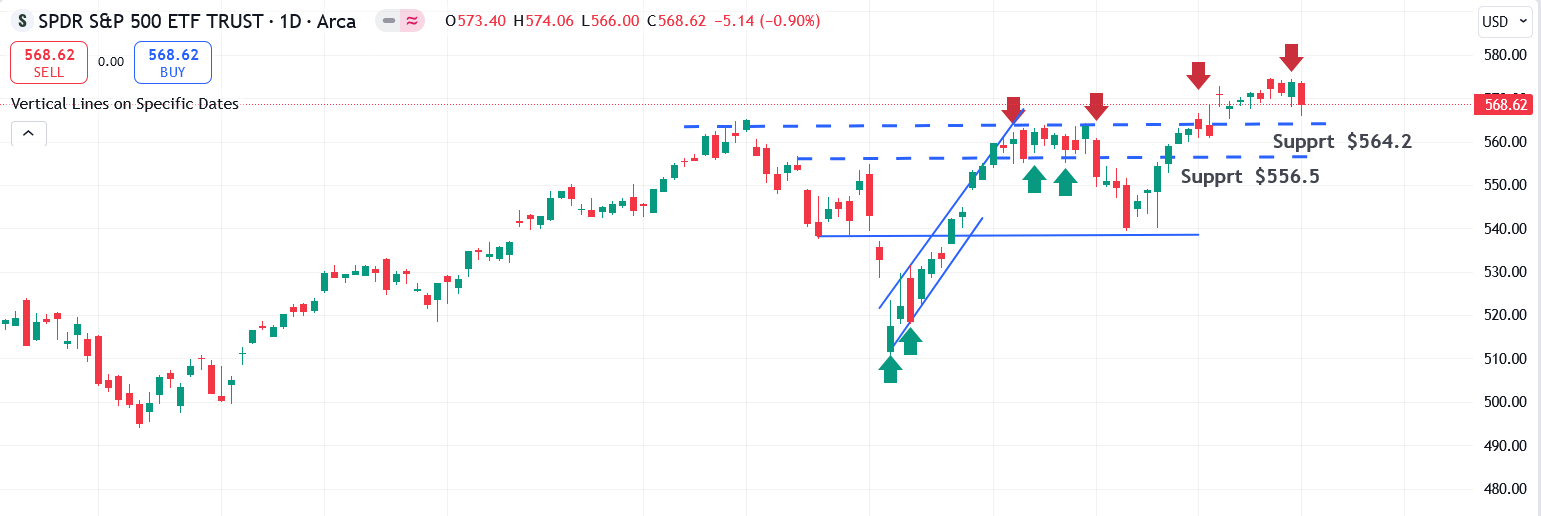

- SPY (S&P 500 ETF): SPY began October by dipping but recovered from its lows.

Upcoming payroll data will be critical, and we expect continued volatility regardless of the report.

A strong jobs report could reignite inflation concerns and delay Fed rate cuts, while a weak report

might shift the focus to earnings worries. Either way, uncertainty is likely to keep the market on

edge.

- QQQ (Nasdaq 100 ETF): QQQ performed worse than the broader market, as predicted.

AAPL has given back all of its gains from Monday. Historically, the first week of October is tough

for AAPL. We remain bullish on META, TSLA, and GOOGL for better setups.

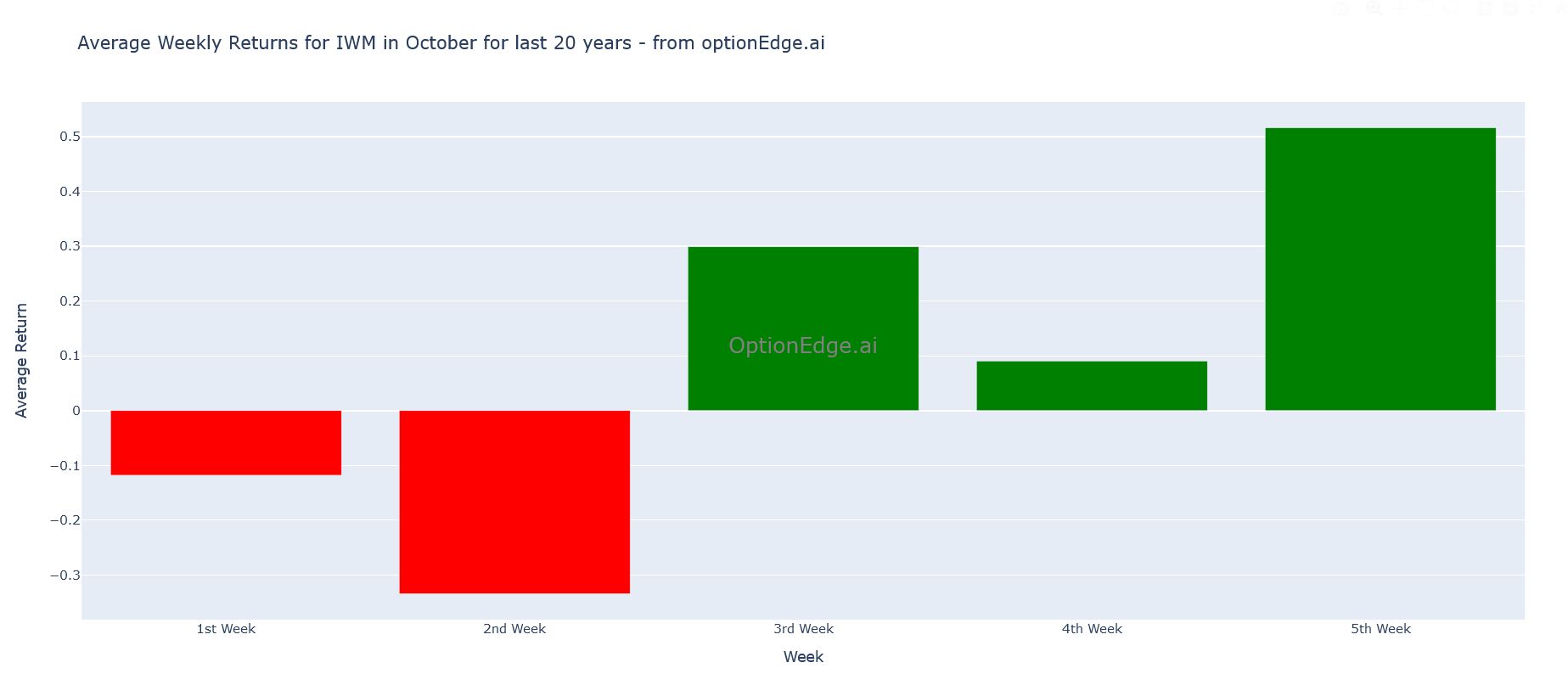

- IWM (Russell 2000 ETF): Regional banks, which make up nearly 10% of the index, tend

to perform well in a low-interest-rate environment. However, the lack of clarity on future Fed

policy has made them volatile and bearish. Regional banks would impact IWM performance. Small caps

lack momentum and are vulnerable to market fluctuations.

We expect IWM to test the 213 level in the next two weeks.

Action Plan for the Week

Looking ahead, the focus will be on key economic data, especially Friday's jobs report. We remain

bearish on semiconductors, energy, financials, and commodities like GLD.

We’ve identified promising setups for Big Tech names like MSFT, GOOGL, META, and TSLA. We’ve recently

closed successful put positions on SPY, IWM, and AMD, all of which hit their targets.

For October, we’re focusing on sectors that traditionally perform well, such as retail (COST, WMT) and

communication services (GOOGL, META). Health insurance companies like UNH also tend to do well this

month.

Featured Trade Ideas

- Gold (GLD): Historically, GLD underperforms during the first week of October.

We’ve

initiated a put position on Gold, expecting it to enter a wave 4 pullback before resuming an

uptrend

in wave 5 (per Elliott Wave analysis).

- GOOGL: GOOGL is hovering near a resistance level. If it breaks out, a long

position

could be considered.

- TSLA: TSLA's delivery numbers are expected today, and we anticipate a

resurgence.

The excitement around Full Self-Driving (FSD) technology could drive further consumer interest.

As a

"Trump trade," TSLA could see upside in the coming weeks.

- AMD: Semiconductors tend to underperform in the first half of October. Our

quantitative model indicates that AMD is likely to find support near 156, with a bearish setup

for

now.

- AXP: We remain bearish on financials, and AXP is displaying a bearish engulfing

pattern.

- XOM: A double top pattern is forming on XOM, indicating a bearish setup.

COIN: Finding support right now. It is directly correlated with Bitcoin.

Bitcoin is a liquidity-driven asset class, and money is rotating to Chinese themes for now. Some

hedge

funds are getting squeezed by Chinese stocks, and highly speculative assets like BTC are being sold

off

first to offset the squeeze. In a few days, it should find normalization.

🔥 Featured Trade Idea: IWM 🔥

Rationale: Our AI quant model anticipates continued volatility in IWM, with a

potential

test of 213–215 levels over the next two weeks. Given the uncertainty around inflation and payroll

data,

caution is advised.

💡 Trading Tip of the Week: Mastering "Trailing Stops" for Risk Management 💡

Strategy: Use Trailing Stops to protect profits and limit losses in volatile

markets. A

trailing stop automatically adjusts as the price moves in your favor, allowing your trade to remain

open

and capture more gains. If the price moves against you by a specified amount, the trailing stop

triggers

an exit. This strategy helps manage risk while letting your winning trades run longer, especially

during

periods of unpredictable market swings..