Hello! We’re excited to bring you this week’s top trade ideas and market insights. Stay ahead with OptionEdge.ai! 🚀

Welcome to Your Weekly Edge 🎯

Weekend Update on Trading Insights and Opportunities

By OptionEdge.ai

Exclusive Premium Content

This is content that only premium members can access.

Market Recap

For the week ending September 27, 2024, the markets gave mixed signals, creating a cautious yet hopeful sentiment.

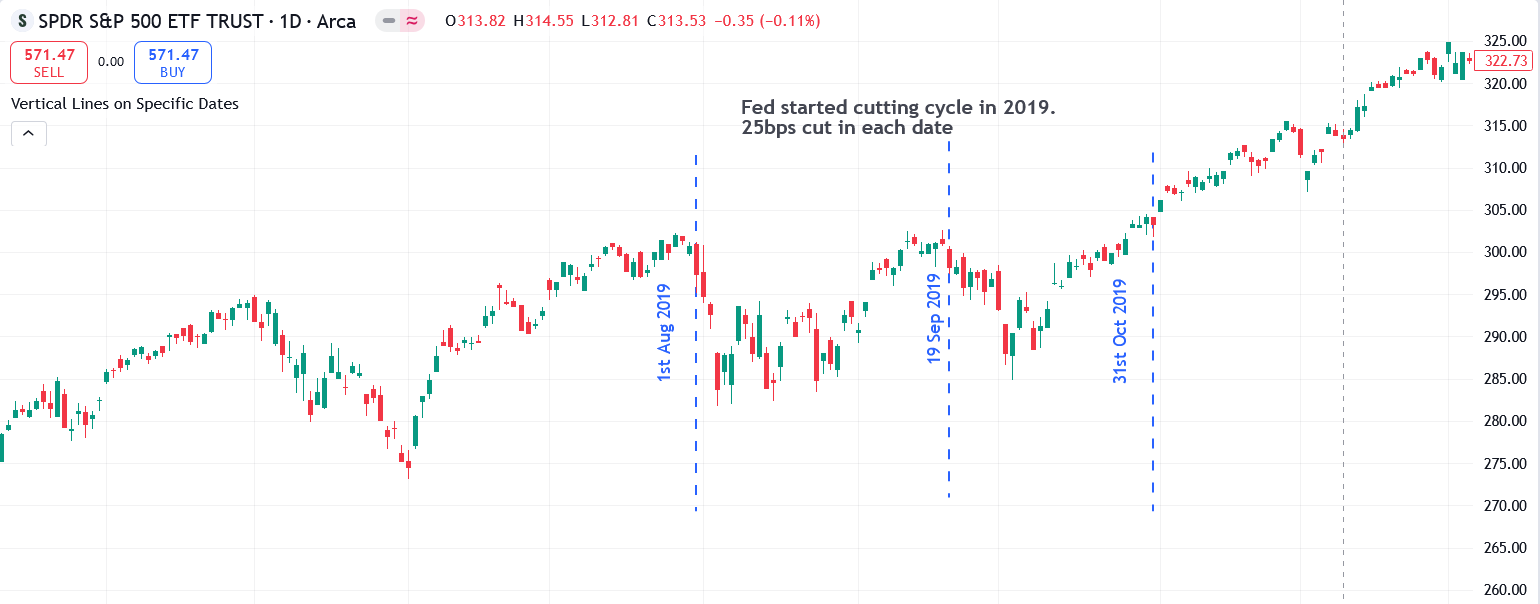

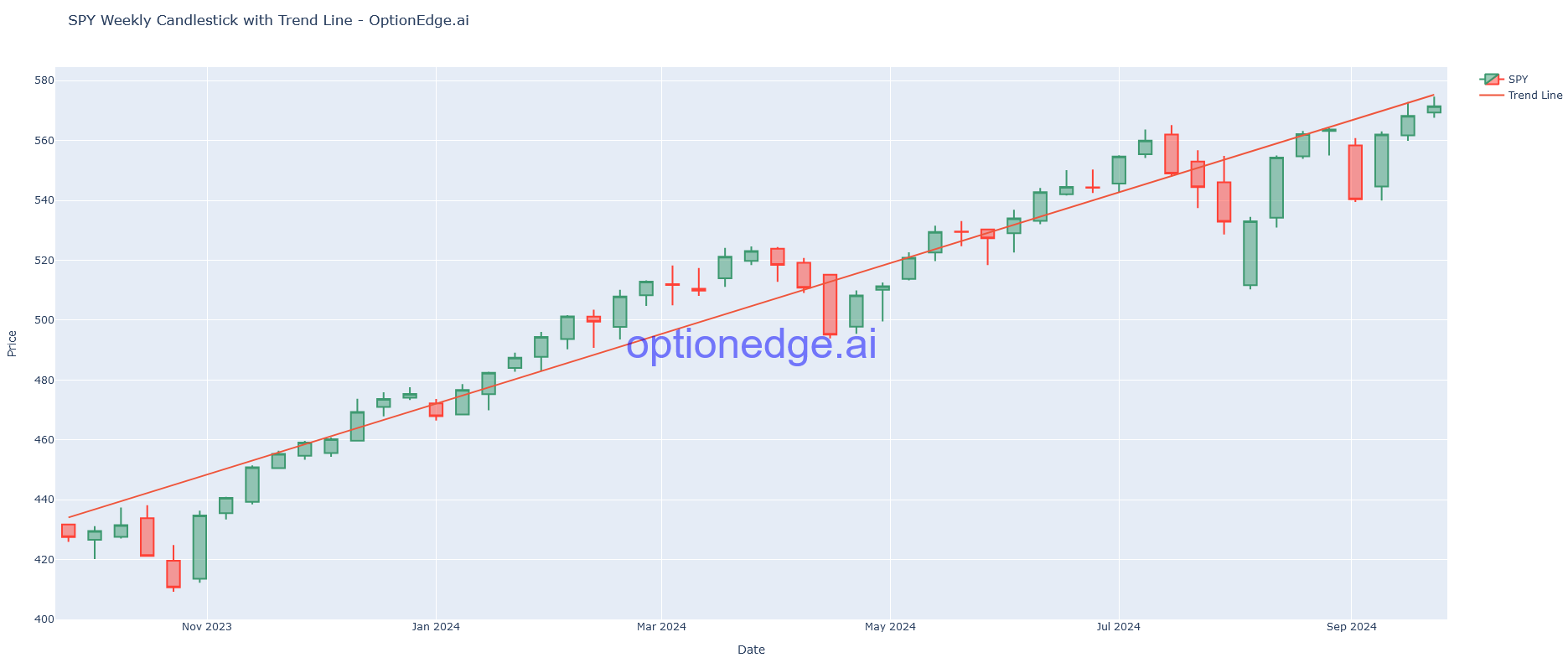

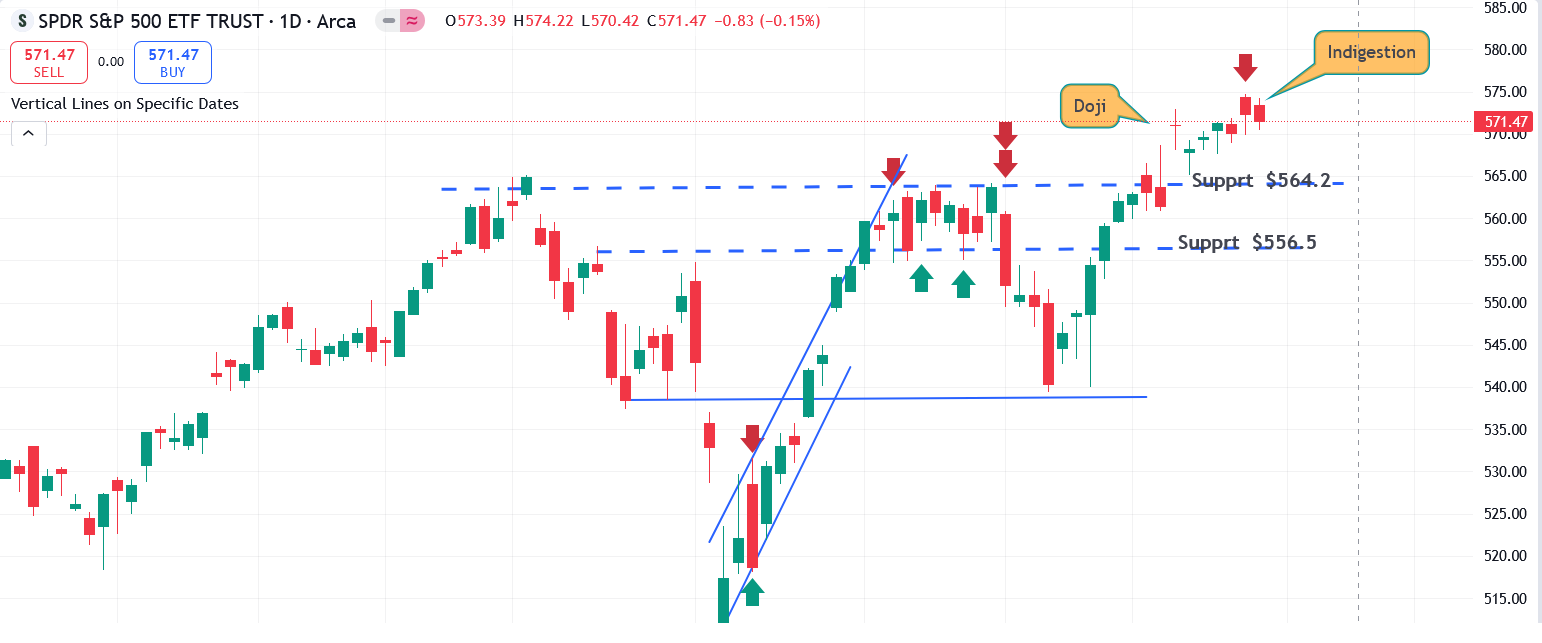

- SPY (S&P 500 ETF) hovered near its all-time high, supported by momentum from the Fed’s easing cycle and potential future rate cuts. However, a late-week pullback, driven by geopolitical tensions and the closely contested U.S. political landscape, introduced some uncertainty. Despite this, SPY remains near its all-time high (ATH), with investors closely monitoring new data to assess the Fed’s next moves. The chart shows a Doji pattern and signs of indecision, which may act as resistance, limiting further upward movement. For the week ending September 27, SPY gained 0.56%.

- QQQ (Nasdaq 100 ETF) experienced a volatile week. Tech stocks, which had previously surged on rate cut expectations, showed signs of caution. AI and semiconductor stocks like Nvidia and AMD saw some profit-taking, but the index remains in a long-term bullish trend. Concerns about high valuations and potential regulatory challenges continue to weigh on traders' short-term outlook. Additionally, new tariffs imposed on China last Friday have added to the uncertainty. For the week ending September 27, QQQ gained nearly 1%.

- IWM (Russell 2000 ETF) rebounded strongly, particularly in the latter half of the week. Small-cap stocks, which had lagged in recent months, outperformed as investor optimism about domestic economic growth improved. IWM is now positioned for a potential breakout if the economic outlook continues to brighten and rate cut expectations rise. For the week ending September 27, IWM was down by 0.2%.

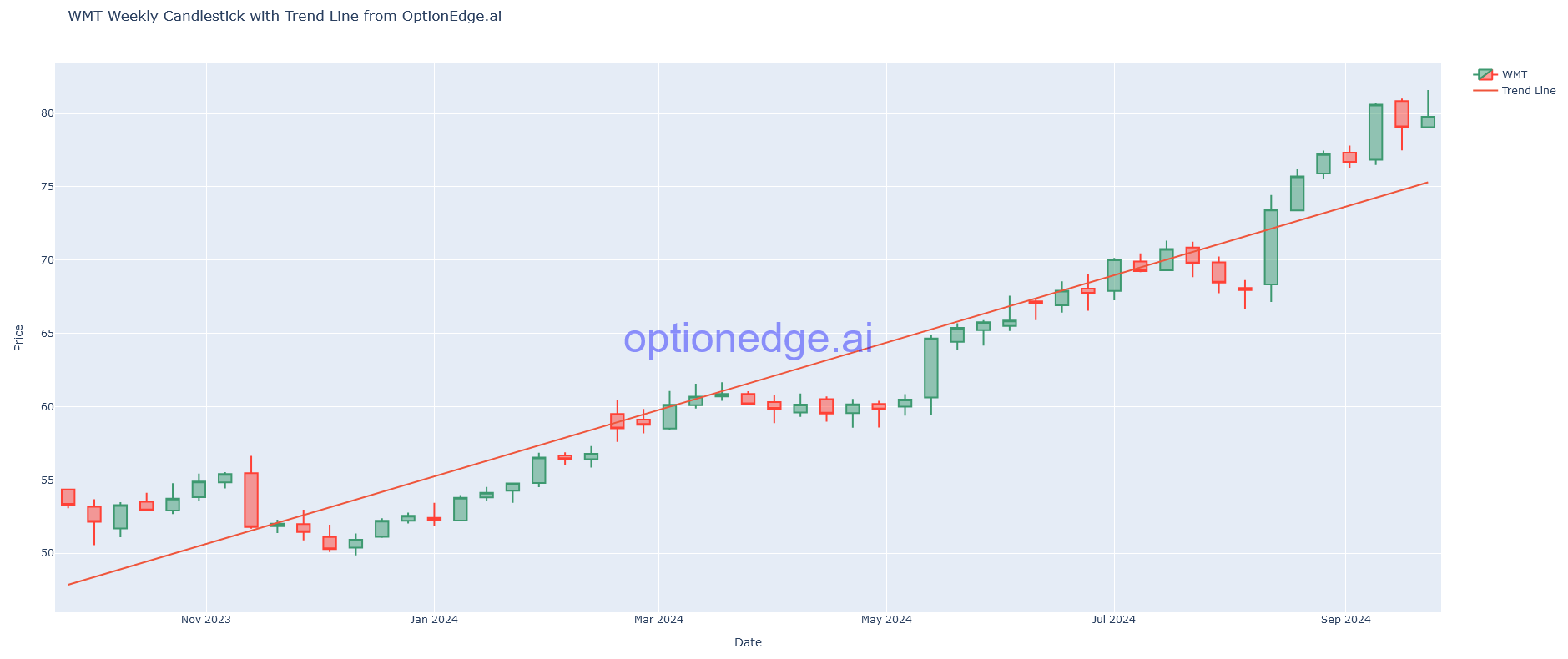

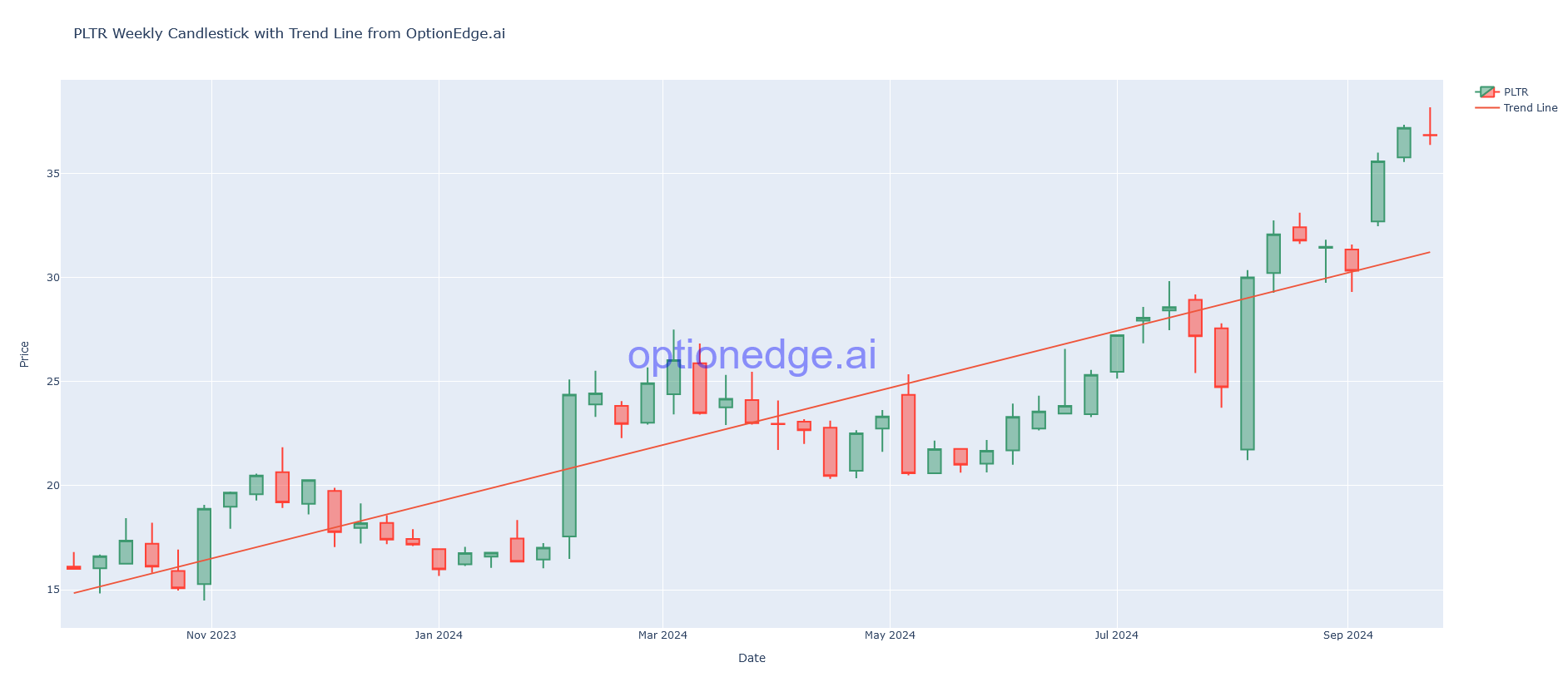

As we predicted last week, we were aggressive on Big Tech calls and took advantage of Friday morning's market surge to close some positions. We remain bearish on Energy and Financials. Volatility remains high, especially with geopolitical tensions flaring up, and political policy announcements influencing short-term market movements. We recommend positioning in Big Tech again, as opportunities arise during market dips. While large tech stocks did well this week, they are now facing a consolidation period.

Next week action plan

Looking ahead, next week’s focus will be on key economic data, including the jobs report and the start of earnings season. Volatility is expected to remain high as investors respond to signals about the Fed's future policy decisions. Additionally, Gold (GLD) has been steadily rising, which could signal potential weakness in the broader market. Historically, the two weeks following a Fed pivot tend to be volatile and carry more downside risk. With the Fed's pivot on September 18th, expect volatility to pick up again starting October 2nd.